Checkit, up 3.6%, today announced that it has appointed Kit Kyte as Chief Executive Officer, with immediate effect.

Oracle Power, up 3.3%, announced that its geochemical sampling programme is underway at its 100% owned Jundee East Gold Project in Australia and would expand on the maiden geochemical sampling programme which returned the highly positive results announced on 14 June 2021.

Xaar, up 2.4%, today announced that it has acquired FFEI Limited, a leading integrator and manufacturer of industrial digital inkjet systems and digital life science technology for £9.1m.

Cambridge Cognition, up 0.3%, announced that it has signed a contract worth £1.0m with a large pharmaceutical company, as the cognitive assessment partner for a phase cancer trial.

Science Group, down 1.7%, in its trading update, announced that all three divisions of the Group witnessed a good start to the year with the momentum continuing throughout the first half. Moreover, it expects to deliver revenue in excess of £40m and adjusted operating profit in excess of £7m for the first half. Meanwhile, the firm expects to release its interim results in the last week of July.

Quixant, down 0.3%, announced that it has appointed Johan Olivier as Chief Financial Officer, with effect from 31 August 2021.

Quartix Technologies, unchanged at 490p, in its trading update, announced that it performed well during the first six months of the year and in line with the market expectations. Further, the group expects revenues of £12.5m, adjusted EBITDA of approximately £2.7m and underlying free cash flow of approximately £1.3m for the period. The company's cash balance stood at £4.2m as at 30 June 2021.

UK markets ended mixed last week, as weaker than expected UK GDP data overshadowed optimism over full economic reopening. On the data front, the UK’s economy grew at a slower pace in May, despite relaxation in lockdown rules, while house prices fell for the first time in five months in June, as the stamp duty tax incentive ended on 30 June. On the flipside, Britain’s services sector expanded at a stronger than expected pace in June, registering its second-highest reading since October 2013, while the nation’s construction activity accelerated to a 24-year high in June, amid increasing demand for residential building and commercial projects.

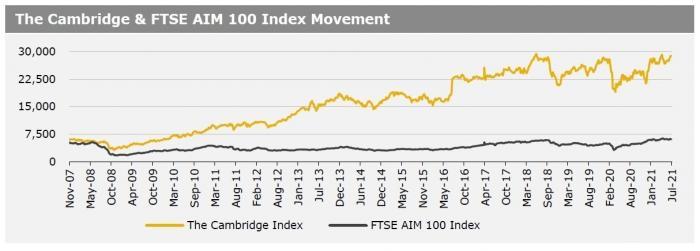

The FTSE 100 index closed flat at 7121.9, while the FTSE AIM 100 index fell 1.6% to close at 6122.4. Meanwhile, the FTSE techMARK 100 index gained 1.0% to end at 6919.2.

US markets ended higher in the previous week, as the US Federal Reserve’s (Fed) latest meeting minutes indicated that the central bank would not tighten its policy anytime soon. On the macro front, the US ISM services sector index fell more than expected in June, while the nation’s weekly jobless claims unexpectedly rose in the week ended 02 July 2021, reviving concerns over the labour market’s recovery. Also, the US JOLTS job openings rose less than expected in May. Separately, the Fed’s June meeting minutes revealed that the central bank is not in a hurry to scale back its asset purchase program. Further, it reiterated that the rising inflation would prove to be transitory. The DJIA index rose 0.2% to end at 34870.2, while the NASDAQ index gained 0.4% to close at 14701.9.