AVEVA Group, up 7.6%, announced that full year revenues dropped to £820.4m from £833.8m recorded in the previous year.

Johnson Matthey, down 3.9%, announced that it has signed a Memorandum of Understanding (MoU) with Plug Power. Separately, the firm, announced that revenues rose to £15.67b from £14.58b recorded in the previous year. Further, the group declared a final dividend of 50p per ordinary share.

CyanConnode, up 25.5%, announced that it has inked a MoU with a joint venture company, Intellismart (Intellismart Infrastructure Private Limited).

SDI Group, up 12.1%, in its trading update, announced that sales and order intake have been strong across all of its businesses in March and April.

Amino Technologies, up 4.6%, announced the acquisition of Nordija, a Danish streaming and Pay TV platform specialist for €5.3m.

Kier Group, up 4.4%, announced that it has won a £75m capital works contract from Hammersmith & Fulham Council for its approximately 17,000 housing stock.

Netcall, up 0.7%, announced that it has introduced a new Liberty platform solution, Tenant Hub, to address the specific needs of the housing sector.

Bango, up 0.2%, announced that its extended partnership with Microsoft has allowed the Bango Platform to enable Telco partners to offer bundled Xbox cloud gaming subscriptions in Europe.

Gaming Realms, down 10.7%, announced that it has been granted an Interactive Gaming Manufacturer Licence by the Pennsylvania Gaming Control Board.

1Spatial, down 4.6%, announced that annual report and accounts along with the notice of the 2021 AGM have been posted on the company's website.

Sareum, down 4.6%, announced that the Covid-19 is causing further delays to the conduct of the final preclinical studies the company needs to complete on SDC-1801 prior to filing an exploratory Clinical Trial Application (CTA).

IQGeo Group, down 0.4%, announced that it has appointed Carolyn Rand as an Independent Non-Executive Director, with effect from 26 May 2021.

Cambridge Cognition, down 0.4%, announced that Nicholas Walters has resigned as Director.

Oracle Power, unchanged at 0.5p, announced that it has been awarded an exploration tenement licence for E53/2140 which contains the Jundee East Gold Project in Western Australia.

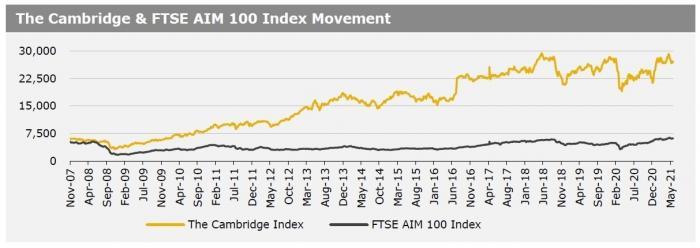

UK markets ended higher last week, following upbeat comments on the outlook for the UK economy by the Bank of England’s Monetary Policy Committee. On the data front, UK’s public sector borrowing fell for the first time since the start of the pandemic in April, as parts of the economy reopened from a third lockdown. Separately, Bank of England policymaker Gertjan Vlieghe stated that the central bank could raise interest rates sooner than expected in the first half of next year, if the economy rebounds quickly and labour market recovers faster than expected. The FTSE 100 index advanced 0.1% to settle at 7022.6, while the FTSE AIM 100 index rose 0.3% to close at 6185.3. Also, the FTSE techMARK 100 index gained 2.8% to end at 6760.8.

US markets ended firmer in the previous week, amid optimism surrounding economic reopening and as inflation worries eased. On the macro front, US jobless claims fell to a 14-month low last week, as layoffs subsided, while the nation’s home prices rose at its fastest pace since 2005 in March. Meanwhile, the US gross domestic product rose less than expected in the first quarter of 2021, while durable goods unexpectedly fell for the first time in 11 months in April, as semiconductor chip shortages disrupted auto production. Moreover, the US consumer confidence index dropped for the first time this year in May, amid concerns over rising inflation, while the nation’s pending home sales unexpectedly dropped to its lowest level in nearly a year in April. The DJIA index rose 0.9% to end at 34529.5, while the NASDAQ index gained 2.1% to close at 13748.7.