DS Smith, down 4%, announced that it aims to align its global operations to a 1.5°C scenario as set out in the Paris Climate Agreement.

GRC International Group, up 10.7%, announced that it has proposed to raise around £3 million through a share placing. The net proceeds from the placing would be used to accelerate investment in SaaS and e-Commerce platforms as well as strengthen the overall balance sheet position and support working capital.

Netcall, up 0.7%, in its trading update, announced that its trading performance was in line with board’s expectations during the first half of the year. Revenue for the period is expected to increase by 10% to £14.7m with good trading across the Group's key market segments. Netcall expects to release its interim results for the six-month period ended 31 December 2021 on 23 February 2022.

Oracle Power, down 4.2%, in its 4Q update, announced that it has ended the last quarter of 2021 on a positive note and has achieved significant progress with the advancement of its two 100% owned gold assets in Western Australia, the Jundee East and Northern Zone projects. Also in Pakistan, it continues to make progress with regards to its Thar Block VI Project particularly in the context of the approved Indicative Generation Capacity Expansion Plan 2021-2030 (IGCEP), prepared by the National Transmission Dispatch Company (NTDC) in Pakistan.

1Spatial, down 2.1%, announced the extension of the capability of their survey application, 1Edit, with increased support for photos and 2.5D data.

Kier Group, down 1.3%, in its trading update, announced that it has performed well in the first half. As a result, it expects its half-year results to be in-line with the Board's expectations. As at 31 December 2021, the group’s order book stood at around £8.0 billion, an increase of nearly 4% from the year-end position. Additionally, the group is expecting a cash outflow in the first half of the year due to the typical unwind of working capital.

Dialight, down 0.9%, announced that it has appointed Clive Jennings as Chief Financial Officer (CFO) and Executive Director, with effect from 18 January 2022.

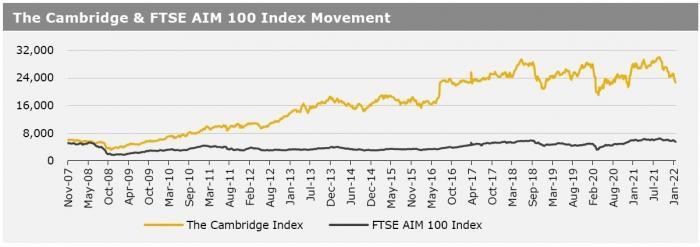

UK markets ended lower last week, amid concerns over looming interest rate hikes. On the data front, UK’s consumer prices accelerated to a 30-year high in December, driven by rise in energy, transportation, food and furniture prices, while the nation’s unemployment rate declined in December, indicating that the country’s labour market has nearly recovered from the pandemic. Additionally, UK’s house prices rose at its highest levels since 2016 in January. On the flipside, British retail sales declined more than expected in December, as the spread of the new Omicron coronavirus variant hampered Christmas sales, while the nation’s consumer sentiment weakened in January, amid concerns over surging inflation. The FTSE 100 index declined 0.6% to settle at 7,494.1, while the FTSE AIM 100 index fell 2.6% to close at 5,462.2. Also, the FTSE techMARK 100 index lost 1.2% to end at 6,599.2.

US markets ended lower in the previous week, amid worries over aggressive monetary policy tightening by the Federal Reserve. On the macro front, the US weekly jobless claims climbed to a three-month high in the week ended 14 January 2022, while the nation’s existing home sales dropped for the first time in four months in December, due to record low inventory. Additionally, the NY Fed manufacturing index fell for the first time in 20 months on Omicron fears and supply chain issues. Meanwhile, the US housing starts unexpectedly rose to a 9-month high in December, amid rise in multi-family housing projects, while the nation’s building permits advanced in the same month. The DJIA index fell 4.6% to end at 34265.4, while the NASDAQ index lost 7.6% to close at 13768.9.