AVEVA Group, down 10.5%, today, announced that it has appointed Dr Ayesha Khanna as an independent Non-Executive Director, with effect from 28 October 2021.

Frontier Developments, down 0.4%, announced that its annual general meeting would be held on 27 October 2021 at The Trinity Centre, 24 Cambridge Science Park, Milton Road, Cambridge, CB4 0FN.

Feedback, up 20%, announced that it has secured a place on a national procurement framework: The Provision Artificial Intelligence (AI), Imaging and Radiotherapy Equipment, Associated Products and Diagnostic Imaging.

Aferian, up 7.6%, announced that its 24i video streaming platform, has been chosen by Cinessance, to provide end-to-end streaming platform service dedicated to French cinema.

Netcall, up 6.2%, announced that it would release its audited results for the year ended 30 June 2021 on 6 October 2021.

1Spatial, up 2.4%, in its interim results, announced that revenues rose to £12.64m compared to £11.73m recorded in the same period previous year. No dividend has been proposed for the six months ended 31 July 2021.

Gaming Realms, down 5.4%, announced that it has signed a commercial agreement with 4ThePlayer.com to integrate its content onto Gaming Realms' platform for distribution in the US.

Oracle Power, unchanged at 0.3p, announced that the National Electric Power Regulatory Authority (NEPRA) has approved a plan to expand electricity generation capacity from the existing 34,776MW to 61,112MW by 2030. Additionally, the NEPRA has directed the National Transmission Dispatch Company (NTDC) to consider its Thar Block VI Project in the Sindh Province of Pakistan for inclusion in the next IGCEP annual review.

UK markets ended lower last week, amid worries surrounding rising inflation and supply chain issues. On the data front, Britain’s economy accelerated faster than estimated in 2Q 2021, raising prospects that the Bank of England might raise interest rates sooner than expected. Meanwhile, UK’s house price inflation slowed in September, while the nation’s manufacturing PMI fell for a fourth consecutive month in August.

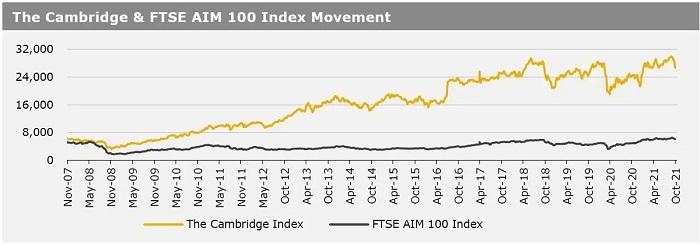

Separately, Bank of England (BoE) Governor Andrew Bailey forecasted UK’s economy to recover to its pre-pandemic level early next year. The FTSE 100 index declined 0.3% to settle at 7027.1, while the FTSE AIM 100 index fell 3.4% to close at 6041.2. Also, the FTSE techMARK 100 index lost 3.8% to end at 7161.0

US markets ended lower in the previous week, on concerns over Covid-19, rising inflation and economic recovery. On the macro front, the nation’s weekly jobless claims unexpectedly rose in the week ended 24 September 2021, while consumer confidence index fell to a 7-month low in September, amid ongoing concerns over the delta variant of Covid-19. Meanwhile, US economy grew more than expected in the second quarter of 2021, while the nation’s durable goods climbed in August, driven by a spike in orders for transportation equipment.

Additionally, the US pending home sales climbed to a seven-month high in August, while the ISM manufacturing PMI unexpectedly rose in September. Separately, US Federal Reserve Chairman, Jerome Powell, in his testimony, warned that inflationary pressures could last longer than expected. However, he stated that continued progress in vaccinations would support a fast economic recovery. The DJIA index fell 1.4% to end at 34326.5, while the NASDAQ index lost 3.2% to close at 14566.7.