Science Group, up 3.4%, announced the acquisition of 58,750,000 shares in TP Group at a price of 6.5p per share, representing 17.9% of the issued voting share capital.

1Spatial, up 2.7%, announced that it would publish its interim results for the six months ended 31 July 2021 on 29 September 2021.

Dialight, up 1.7%, announced that it has unveiled new ProSite LED floodlight range for the EMEA and APAC markets.

Bango, up 0.9%, announced that CEO, Paul Larbey, CFO, Matt Garner and CMO, Anil Malhotra, would conduct a live presentation relating to the company’s interim results through the Investor Meet Company platform on 10 September 2021 at 11am BST.

Sareum, down 20.3%, in its trading update, announced that it expects to start Phase 1 clinical trials for the UKRI-funded Covid-19 research project for SDC-1801 in early 2022, following the successful completion of the ongoing preclinical toxicology studies, gaining the requisite approval and financing. Further, Sareum continues to work on the design of the translational studies needed to define the optimal cancer application prior to completing toxicology and manufacturing studies. Also, the company continues to monitor licence holder Sierra Oncology's activities as it explores options to fund the future development of SRA737. The salary deferral scheme will end in August 2021, with a total of £155k, following the significant £4.5m improvement in the Company's financial position arising from the recent share subscriptions and warrant exercise.

Aferian, down 0.7%, announced the completion of the acquisition of its remaining 8% interest in 24i Unit Media B.V and its subsidiaries.

UK markets ended mostly higher last week, following upbeat domestic jobs data. On the data front, UK’s unemployment rate declined in June, as job vacancies rose, while industrial production climbed by the most in four months in July. Meanwhile, UK’s inflation slowed more than expected in July, reaching the Bank of England’s target of 2%, led by decline in footwear and apparel prices, while the nation’s consumer confidence index fell in August, amid concerns over the possible economic implications of rising Covid cases.

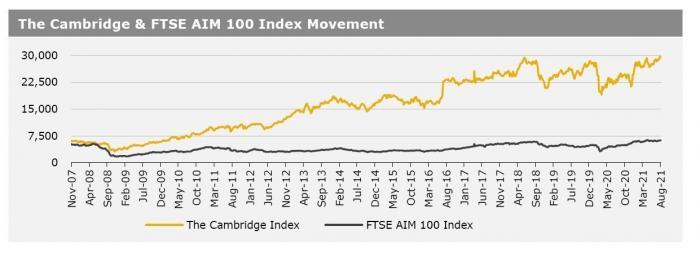

Additionally, Britain’s retail sales unexpectedly fell in July, signalling that a sharp recovery may be losing momentum. The FTSE techMARK 100 index gained 0.7% to end at 7526.6, while the FTSE AIM 100 index rose 0.3% to close at 6279.3. Meanwhile, the FTSE 100 index declined 1.8% to settle at 7087.9.

US markets ended lower in the previous week, after the US Federal Reserve (Fed) indicated that it will start tapering its asset purchases this year. On the macro front, US retail sales dropped in July, for the second time in three months, as consumer spending shifted towards services and amid continued drop in sales by motor vehicle and parts dealers. Additionally, housing starts declined to a three-month low in July, driven by higher material costs and home prices.

On the flipside, the nation’s weekly jobless claims dropped to a 17-month low in the week ended 13 August 2021, reflecting continued improvement in the jobs market, while building permits climbed in July. Separately, the latest FOMC minutes revealed that most officials discussed reducing the pace of asset purchases before the end of the year, while “some” members preferred to wait until early 2022 to start tapering. The DJIA index fell 1.1% to end at 35120.1, while the NASDAQ index lost 0.7% to close at 14714.7.