AVEVA Group, up 0.8%, announced that all resolutions were passed at the AGM held on 21 July 2020.

Johnson Matthey, down 0.7%, in its trading update, announced that its first half operating performance was materially below last year, due to weaker activity in its Clean Air division. Clean Air sales were down c.50% in first quarter, primarily driven by weaker consumer demand and temporary customer shutdowns in Europe and the Americas. Further, the firm has planned to cut 2,500 jobs and expects to deliver total annualised cost savings of c.£225m by the end of 2022/23.

DS Smith, down 2.1%, announced that Geoff Drabble, who will join the company as Chairman Designate and Non-Executive Director with effect from 1 September 2020, purchased 60,000 shares in the company on 20 July 2020.

Abcam, down 5%, in its trading update, stated that its revenue declined by around 10% in the second half of the year. Despite the impact of COVID-19, Abcam expects its gross margin and adjusted operating margin for the full year to be approximately 69% and 16-17%, respectively. Further, it will announce its full year results on 14 September 2020. RBC Capital Markets reiterated its “Outperform” rating on the stock with a target price of 1350p.

Sareum Holdings, up 54.8%, announced that positive results have been published for its small molecule dual tyrosine kinase 2 (TYK2) and Janus kinase 1 (JAK1) inhibitors in disease model studies of systemic lupus erythematosus (SLE) by its collaborator, SRI International.

Oracle Power, up 7.4%, announced that in line with its investor communication programme, a recording of the shareholder Q&A session with the Chief Executive Officer, Naheed Memon, is available on the company’s website.

SDI Group, up 7.3%, in its full year results, announced that its revenues jumped to £24.5m from £17.4m recorded in the previous year. Its profit before tax widened to £3.3m from £2.1m. Its diluted earnings per share rose to 2.6p from 2.1p. Further, the company stated that it has entered current year with a strong financial position, and witnessed more demand for its medical products.

Marshall Motor, up 2%, announced that it will post its interim results for the six months ended 30 June 2020 on 18 August 2020.

Quixant, up 1.3%, in its trading update, announced that it has witnessed its Densitron business has progressed well in 2020, as the economy emerges from lockdown. However, its key gaming market has received less orders for the past three months, with most of the firm’s gaming clients closed due to the COVID-19 pandemic. The results for the six months ended 30 June 2020 will be released on 30 September 2020.

Tristel, down 11%, in its trading update, announced that it expects 21% of increase in turnover, with it being no less than £31.6m, and its pre-tax profit is expected to be around £6.8m.

Amino Technologies, down 2.1%, announced that it will release its interim results for the six months ended 31 May 2020 on 11 August 2020.

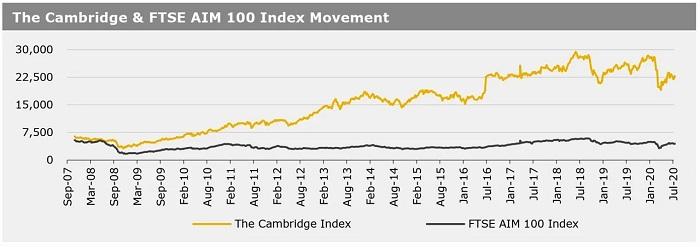

UK markets closed mostly lower last week, as fears of a no-deal Brexit resurfaced. In economic news, public sector net borrowing deficit in the UK narrowed less than expected in June. Meanwhile, the nation’s manufacturing activity climbed to its highest level since 2019 in July and the services PMI rose more than expected in July. Moreover, British retail sales advanced more than expected in June. The FTSE 100 index declined 2.6% to settle at 6123.8, while the FTSE AIM 100 index rose 0.3% to close at 4447.5. Meanwhile, the FTSE techMARK 100 index lost 0.2% to end at 5461.8.

US markets ended weaker in the previous week, amid rising tensions with China and a potential stalling of the economic recovery. On the data front, the US manufacturing and service sector activity PMIs rose less than expected in July, whereas the US home sales climbed more than expected in June. Additionally, the US Chicago Fed National Activity Index unexpectedly rose in June, while existing home sales jumped less-than-expected in June. The DJIA index fell 0.8% to end at 26469.9, while the NASDAQ index lost 1.3% to close at 10363.2.