Abcam, down 2.2%, in its interim results announced that revenues rose to £297.7m from £260.0m recorded in the same period a year ago.

Feedback, up 7.1%, announced that it has signed a Memorandum of Understanding (MoU) with Qure.ai to review technical collaboration between Bleepa and Qure.ai technologies.

1Spatial, up 6.5%, announced that it has won a major new multi-year contract to support UK Government's Geospatial Commission to deliver the National Underground Asset Register (NUAR) project.

IQGeo Group, up 6.5%, in its interim results announced that revenues advanced to £6.38m from £4.72m recorded in the same period last year.

Gaming Realms, up 5.7%, in its interim results announced that revenues climbed to £7.75m from £5.18m recorded in the same period previous year. The Board expects trading for FY21 to be in line with market expectations and remains confident in the strategic outlook for the business.

Quixant, up 4%, announced that Chief Executive Officer, Jon Jayal and Chief Financial Officer, Johan Olivier, would conduct a live presentation regarding its results for the six months ended 30 June 2021 on 23 September 2021 at 4:30pm BST.

Science Group, up 2.7%, announced that its general meeting would be held on 30 September 2021.

Checkit, up 1.9%, in its interim results announced that revenues rose to £7.9m from £6.4m recorded in the same period previous year.

Xaar, down 10.9%, in its interim results announced that revenues rose to £26.3m from £23.7m recorded in the same period a year ago. No interim dividend has been declared for 2021.

Kier Group, down 1.1%, in its results for the year ended 30 June 2021, announced that revenues dropped to £3,261.0m from £3,422.5m recorded in the same period previous year. No interim or final dividends have been declared during the year (2020: £nil).

Bango, down 0.2%, announced that it has signed a deal with US telecommunications giant, Verizon to power its third-party services.

Oracle Power, unchanged at 0.3p, announced that its drill programme is underway at the Northern Zone Gold Project, located 25km east of Kalgoorlie in Western Australia.

UK markets ended lower last week, amid concerns over rising inflation. On the data front, UK’s retail sales fell for a fourth straight month in August, amid supply chain issues, labour shortages. Meanwhile, Britain’s consumer price inflation accelerated to more than a nine-month high level in August, driven by rise in food and fuel prices, while the nation’s retail price index climbed in the same month. Additionally, UK’s unemployment rate declined in three months to July, in line with expectations, as companies continued on a hiring spree.

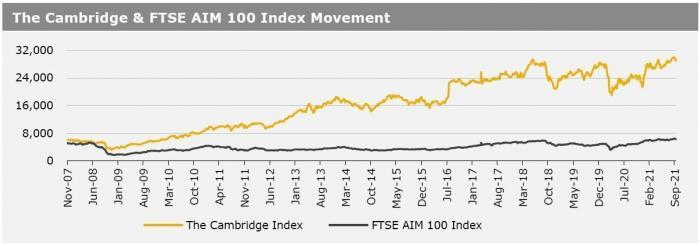

The FTSE 100 index declined 0.9% to settle at 6963.6, while the FTSE AIM 100 index fell 2.0% to close at 6285.7. Also, the FTSE techMARK 100 index lost 0.2% to end at 7427.3.

US markets ended lower in the previous week, amid possibility of a corporate tax rate hike and renewed worries over the pace of global economic recovery. Meanwhile, US President Joe Biden warned that the economy is at risk of falling back into recession. On the macro front, US consumer prices increased at its slowest pace in six months in August, as used car prices tumbled, while the nation’s industrial production rose less-than-expected in the same month, as Hurricane Ida resulted in late-month shutdowns. Moreover, weekly jobless claims rose more-than-expected in the week ended 10 September 2021, indicating disruption in the labour market recovery. On the other hand, the US retail sales rebounded in August, helped by increased online spending.

The DJIA index fell 0.1% to end at 34584.9, while the NASDAQ index lost 0.5% to close at 15044.