Johnson Matthey, up 2.3%, announced that it has entered into an agreement to supply cutting-edge technologies, equipment and advisory services to the world’s first methanol plant to harness energy from the wind, the Haru Oni project in Patagonia, Chile.

Abcam, down 4.3%, announced that Dr Alejandra Solache, SVP of Research & Development has received the CiteAb award for ‘Significant Individual Impact’ and the company was recognised as ‘Antibody Supplier Succeeding in Cardiovascular Research’.

Sareum, up 24.6%, announced that it would release its interim results for the six months ended 30 December 2020, before 30 April 2021.

Cambridge Cognition, up 17.4%, in its unaudited preliminary results for the year ended 31 December 2020, announced that revenues rose to £6.74m from £5.04m recorded in the previous year. Loss before tax narrowed to £0.65m from £3.12m.

Quartix, up 12.9%, announced that trading performance for the two-month period to 28 February 2021, was consistent and in line with market expectations for the year.

Feedback, up 6%, announced that it has secured a £84,000 contract for one year, with the Royal Berkshire NHS Foundation Trust, for Bleepa, its flagship clinical communications platform, across a number of targeted clinical settings. The contract funding has been drawn down from the NHSx National Clinical Communication Tool Framework. Separately, the firm announced that it has appointed two leading industry specialists in India, Siva Ramamoorthy and Dr Venkat Ramana Sudigali, to evaluate the potential prospects for Bleepa.

IQGeo Group, down 0.5%, in its final results for the 12 months ended 31 December 2020, announced that revenues rose to £9.16m from £7.81m recorded in the last year. Loss before tax narrowed to £4.43m from £6.23m. The Board believes it inappropriate to commence paying dividends.

UK markets ended mostly higher last week, amid optimism over Britain’s vaccine rollout and economic recovery. On the data front, UK’s unemployment rate unexpectedly fell in the three months to January, showing signs of improvement in the country’s job market, while the nation’s manufacturing and services PMIs accelerated in March, ahead of the easing of lockdown rules. Moreover, retail sales rebounded in February, helped by increase in spending on household goods and home-improvement supplies.

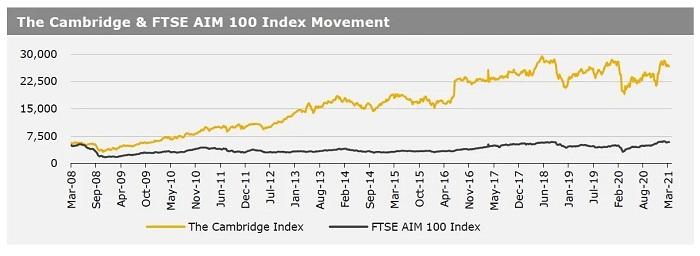

Meanwhile, Britain’s consumer price inflation slowed in February, driven by fall in prices of clothing and footwear. In major news, the European Union has threatened to impose a ban on COVID-19 vaccine exports to Britain and other countries, with higher infection rates. The FTSE 100 index advanced 0.5% to settle at 6740.6, while the FTSE techMARK 100 index gained 1.1% to end at 6505.9. Meanwhile, the FTSE AIM 100 index fell 0.3% to close at 5878.4.

US markets ended mixed in the previous week, as concerns about infrastructure costs and potential tax hikes was offset by optimism over economic recovery. On the macro front, the US economy accelerated more than expected in 4Q 2020, while weekly jobless claims fell to its lowest level in a year in the week ended 19 March 2021, boosting prospects for smooth economic recovery. Meanwhile, the nation’s durable goods orders fell for the first time since April 2020 in February, while new home sales dropped to a nine-month low in February, due to extreme cold weather conditions. Also, both, the US personal income and consumer spending dropped in February, amid continued Covid-19 led restrictions and closures. Meanwhile, US Federal Reserve Chairman Jerome Powell said the central bank witnessed progress in economic recovery and expressed confidence in the US economy. The DJIA index rose 1.4% to end at 33072.9, while the NASDAQ index lost 0.6% to close at 13138.7.