The manufacturing industry in China is vital to its economic growth, employment generation, technological development, and global competitiveness. To strengthen China’s economic and national development, the Chinese government has been actively pursuing policies and strategies to diversify and enhance manufacturing. This article details those policies and strategies, gives an overview of the current manufacturing conditions in China and the UK with a focus on electronic products, and analyses the significance of UK and China collaboration within the manufacturing industry.

The Chinese government’s policies and strategies

In 2023, the Chinese government issued several policies and strategies to enhance manufacturing.

In February, China’s Central Committee and State Council issued the “Outline for Building a Powerful Country with Quality.” The plan aims to improve traditional manufacturing, promote high-end and intelligent development, and prioritise quality competitiveness. The outline can be summarised as follows:

- By 2025, the goals are to enhance the overall quality of manufacturing, boost Chinese brands, and emphasise the role of quality in economic and social development. Targets include a quality competitiveness index of 86 and a 94% qualification rate for manufacturing products.

- By 2035, China aims to have a solid foundation for quality-driven development, a widespread advanced quality culture, and a higher overall quality and branding strength.

In June 2023, the Ministry of Industry and Information Technology, along with four other departments, issued the “Implementation Opinions on Improving Manufacturing Industry Reliability.” This plan consists of two phases:

- The first phase is to strengthen reliability by establishing demonstrations and promoting it in over 1,000 enterprises by 2025.

- The second phase is to attain internationally advanced levels of reliability in 10 key core products, foster competitive public service institutions and professionals, and elevate the overall reliability of China’s manufacturing industry to support high-quality development by 2030.

The Implementation Opinion addresses the mechanical, electronic, and automotive industries which play significant roles in the improvement of reliability within the manufacturing sector. The “Implementation Opinions” specifically target these three industries and aims to enhance the reliability of core components and basic electronic parts, promoting overall product reliability in related sectors and strengthening industrial and supply chain resilience.

Various regions in China have also introduced new measures to promote the high-quality development of manufacturing, such as Zhejiang’s recent plan to create advanced manufacturing industry clusters (2023-2027) and Shanghai’s initiatives to develop manufacturing companies with global competitiveness through digital transformation.

China’s high-quality development will prioritise technological innovation, modernising the industrial system, and green transformation. Opportunities for the manufacturing industry include the development of independent and controllable industry chains, support for specialised and innovative small and medium-sized enterprises, digital and green transformation, and potential policies to attract foreign investment – particularly in high-tech manufacturing and major projects.

Overview of China’s manufacturing industry and electronics

Data from the Ministry of Industry and Information Technology shows that in 2022, the added value of China’s manufacturing industry accounted for 27.7% of the GDP, and the size of the Chinese manufacturing industry has ranked first in the world for 13 consecutive years. A total of 65 Chinese manufacturing companies were shortlisted for the world’s top 500 companies in 2022, and the number of specialised small and medium-sized enterprises has now reached over 70,000.

The digital era has caused a surge in demand for intelligent electronic products, transforming the electronic equipment manufacturing industry. Advanced technologies like the industrial Internet, 5G, and big data are driving this transformation, enabling intelligent manufacturing, and showcasing emerging industrial technologies. Leading manufacturers like Foxconn, Huawei, Gree, and Xiaomi have established intelligent factories, marking a new era in high-end electronic equipment manufacturing.

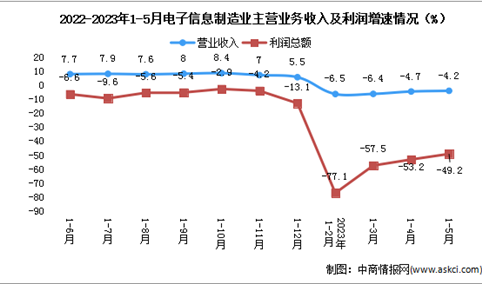

In 2023, from January to May, the electronic and information manufacturing industry – for enterprises above designated size – achieved business revenue of 5.45 trillion yuan, a decrease of 4.2% year-on-year. The decline narrowed by 0.5 percentage points compared to the period from January to April. The profit margin for business revenue was 2.4%, an increase of 0.4 percentage points compared to the period from January to April.

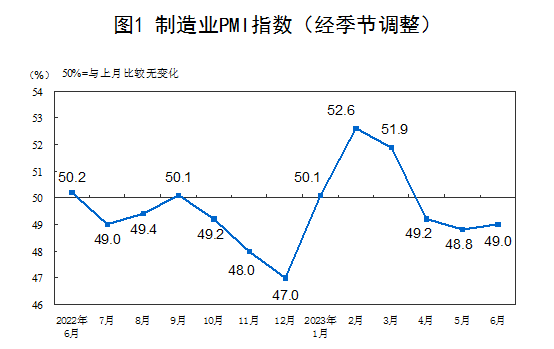

In June, the Purchasing Managers’ Index (PMI) for China’s manufacturing sector was 49%, an increase of 0.2 percentage points from the previous month, indicating the level of manufacturing industry prosperity has improved.

Source: National Bureau of Statistics

Both production and demand indices have rebounded. In June, the production index was 50.3%, up 0.7 percentage points from the previous month. The new order index was 48.6%, up 0.3 percentage points from the previous month. The PMI for equipment manufacturing and high-tech manufacturing was 50.9% and 51.2%, respectively, up 0.5 and 0.7 percentage points from the previous month, marking two consecutive months of growth and indicating increased expansion in these industries.

The Chinese smart wearable device industry has received significant attention and support from government policies. The market has experienced substantial growth, with the size of smart wearable devices increasing at a compound annual growth rate of 34.6% from 2017 to 2021. Although there was a temporary decline in shipment volume in 2022, it is expected to rebound and reach 150 million units in 2023. The industry is benefiting from the expansion of 5G networks and gigabit broadband application scenarios. Wearable devices focused on health monitoring are leading the market, generating a large amount of health data that can be utilised through big data and cloud service technologies. Technological advancements, growing consumer interest, and increased purchasing power are driving the progress of smart wearable devices in China’s market.

Current conditions of the UK Manufacturing industry

The United Kingdom has a diverse and dynamic manufacturing industry, which includes various sectors such as automotive, aerospace, pharmaceuticals, food and beverages, chemicals, machinery, and electronics. Each sector has its own characteristics and contributes to the overall manufacturing landscape. The UK has been investing in advanced manufacturing technologies to enhance productivity and competitiveness, in areas such as robotics, automation, additive manufacturing (3D printing), artificial intelligence (AI), and the Internet of Things (IoT).

The Make UK/BDO Q2 Manufacturing Outlook survey reveals a positive overall outlook, driven by strong demand in the ‘Other Transport’ sub-sector (aerospace, shipping, and rail manufacturing) and the ‘Electronics’ sub-sector (with high demand from Europe). Despite predicting a slight contraction in manufacturing for 2023, the outlook is much better than previously anticipated. The report emphasises the role of digital transformation in delivering efficiencies for manufacturers, streamlining processes, and improving productivity.

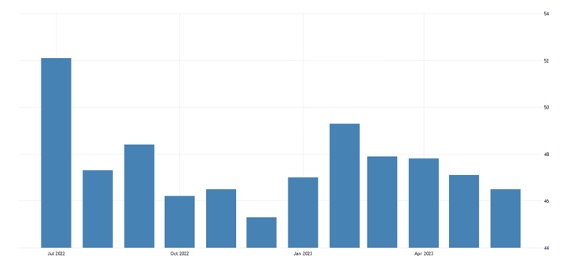

The S&P Global/CIPS UK Manufacturing PMI for June 2023 was revised upward to 46.5, surpassing the preliminary estimate of 46.2, but still lower than May’s reading of 47.1. This indicates a contraction in the manufacturing sector for the past 11 consecutive months. Although output continued to contract for the fourth month in a row, the pace of contraction slowed. The report shows that new orders and employment are still in contraction, and business confidence reached a six-month low.

Source: Trading Economics

The serious shortage of overseas market demand has become a key factor in limiting the British manufacturing industry. S&P Global Market Intelligence director, Rob Dobson, said on the matter: “Producers are being hit by weak domestic and export market conditions, with clients showing a greater reluctance to commit to spending due to market uncertainty, increased competition, and elevated costs.”

UK-China collaboration in the manufacturing industry

China has the world’s largest manufacturing economy and has a vast consumer market. Collaborating with Chinese manufacturers can provide the UK with greater access to this market, allowing British companies to expand their customer base and increase their exports exponentially.

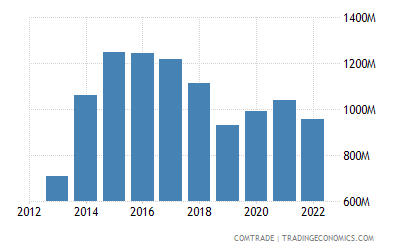

In 2022, the UK exported $35.56 billion worth of goods to China, with electrical and electronic equipment accounting for $954.78 million and ranking 7th among UK exports to China. This data highlights the high demand for electrical and electronic equipment in the Chinese market.

Source: Trading Economics

The historical data in the last 10 years further suggests how large China’s consumer market for UK electrical and electronic products is.

China is also an important partner in providing goods to the UK. The top 5 products imported to the UK from China during the four quarters of 2022 are shown in the following figure, including telecom and sound equipment, office machinery, and other manufactures. This highlights that a diverse range of goods are being imported from China into the UK.

China is known for its cost-effective manufacturing capabilities. By collaborating with Chinese manufacturers, the UK can benefit from lower production costs, which can enhance the competitiveness of British businesses and potentially lead to cost savings for consumers. Collaborating with China in manufacturing can help the UK reduce its dependence on a single source for critical components and materials. By building partnerships with Chinese manufacturers, the UK can create a more robust and diversified supply chain network.

HOW CRAYFISH CAN HELP

At Crayfish, we provide tailored solutions to help you succeed in China and are always happy to discuss how we can support. Get in touch and book a free initial consultation with our specialist team.