When thinking of the applications of low-loss materials in 5G devices, the first that comes to mind for most is 5G smartphones. After all, low-loss materials are integral in enabling advanced 5G antennas-in-packages (AiP) for smartphones, and high-profile smartphone manufacturers like Apple have gone back and forth about which low-loss material they chose for their 5G antennas in their flagship phones like the iPhone. However, another 5G application for low-loss materials hiding in plain sight will act as an important driver for this US$1.8 billion market as forecast by IDTechEx: 5G customer premises equipment (CPEs).

5G Fixed Wireless Access (5G FWA) and CPEs

This application area is based on the increasing deployment of 5G fixed wireless access (FWA). FWA offers wireless internet access to homes and businesses without requiring the laying of fiber or cables to facilitate connectivity. FWA enables customers to get high-speed internet access with speeds comparable to wired broadband connections in places where fiber or cable installation is too expensive or difficult. While fixed wireless technologies based on 4G/LTE do exist, they cannot match the speeds of wired broadband and are also not economically viable to deploy.

However, this changes with the takeoff of 5G technologies. Next-generation 5G FWA products are expected to offer data transfer rates competitive with fiber broadband connections without the complexities introduced by fiber installation. The improvements in performance with 5G FWA can be partly attributed to the expected use of mmWave 5G frequency bands (greater than 24GHz) plus advanced antenna technologies such as massive MIMO and beamforming. IDTechEx expects that the total revenue for 5G FWA will reach nearly US$300 billion by 2033, as forecast in their report, "5G Market 2023-2033: Technology, Trends, Forecasts, Players".

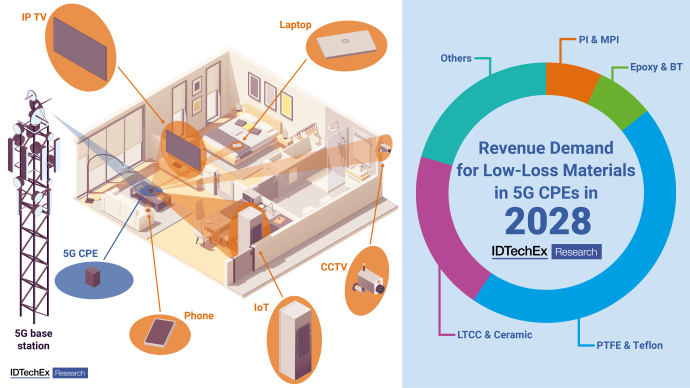

Importantly, the implementation of 5G FWA requires customer premises equipment (CPEs) - devices in residences and businesses that can connect to a 5G access unit and create a high-speed Wi-Fi network within the building. CPEs are less comparable to base stations and more analogous to Wi-Fi repeaters. They receive 5G cellular signals from 5G base stations and then transform those cellular signals into Wi-Fi signals so more devices within the building, like laptops, can connect to the 5G network. It is clear that CPEs are integral for the future expansion of the 5G and FWA network into homes and businesses.

The Challenges of 5G FWA and CPEs

While 5G FWA sounds incredibly promising, it still faces challenges in its real-life application. The biggest challenge is that mmWave 5G radio transmission struggles with high transmission losses, which decreases its coverage area. Additionally, mmWave 5G signals are susceptible to disruption from environmental factors like rain and foliage. While advanced antenna technologies can help alleviate these issues, they are often expensive to implement, which is undesirable for a technology with limited commercial deployment, like 5G FWA. Clearly, the high transmission losses inherent with mmWave 5G present barriers to the global installation and propagation of 5G FWA.

Low-loss Materials' Opportunity in 5G CPEs

Given the need to decrease transmission losses for 5G CPEs, low-loss materials will need to be extensively utilized in the PCBs and RF componentry of CPEs to reduce signal loss, especially for mmWave 5G CPEs. While sub-6GHz 5G CPEs using incumbent dielectric materials like epoxy-based laminates exist, their performance is inadequate for mmWave 5G CPEs, whose higher data speeds are needed for the broader implementation of 5G FWA. Incumbent materials are also less suitable for the miniaturization of RF components, which are needed in CPEs to keep their smaller footprint. This presents a strong opportunity for emerging thermoplastics and ceramics to grab market share in a growing market.

Such emerging low-loss materials will still face challenges; while vendors will want to utilize ultra-low-loss materials to increase their CPEs' performance, said materials are also quite expensive. This could make installing 5G CPEs in every home or business economically unviable for the vendor. Still, there is a reason why so many major 5G vendors, like Samsung, Nokia, and Huawei, are launching their own CPEs. With millions of potential CPE installations in future years, 5G FWA may grow to be a hundreds-of-billions dollar market. 5G CPEs, with installation numbers closer to 5G smartphones and materials usage closer to small base stations, are a major underrated application for low-loss materials.

Market Forecasts for Low-loss Materials for 5G and 6G

IDTechEx's latest report, "Low-loss Materials for 5G and 6G 2023-2033", explores the major application areas driving the growth of the low-loss materials market for 5G and 6G, like 5G CPEs. IDTechEx forecasts future revenue and area demand for low-loss materials for 5G while carefully segmenting the market by frequency (sub-6 GHz vs. mmWave), six material types, and three application areas (smartphones, infrastructure, and CPEs) to provide sixty different forecast lines.

For further information on low-loss materials for 5G and 6G, including material benchmarking studies, player analysis, market drivers and barriers, and granular 10-year market forecasts, see the IDTechEx report - www.IDTechEx.com/LowLossMats.