We’ve discussed IP protection concerns in China but we have yet to explain why China surpassed the US as the top source of international patent applications for IP services. Evidently, China’s Intellectual Property market is ripe with opportunities….but why should UK businesses care?

We have compared a handful of datasets to discover that investment and focus in Research and Development has increased overall. However China requires foreign IP to supplement the fundamental research that continues to be the focus of Higher Education and Research Institutions. This is where the IP opportunity lies.

That’s where opportunities may lie.

Commercial IP drivers

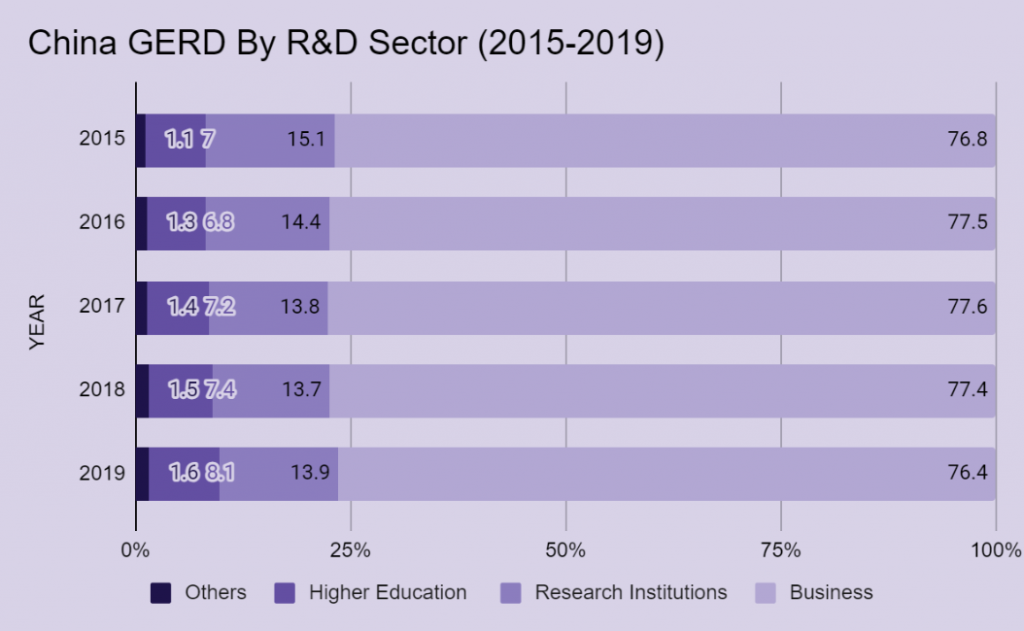

China’s Growth Domestic Expenditure for Research & Development (GERD) has increased in Higher Education (HEI) and Research Institutions:

(Source: Ministry of Science and Technology of China)

Businesses have continued to dominate China’s GERD, however in spite of numerous regulatory and investment hurdles Higher Education and Research Institutions have marginally increased their share. This was in part due to President Xi Jinping’s speech at the 19th Party Congress in October 2018. He outlined the necessity to “strengthen basic research and make breakthroughs in pioneering basic research and groundbreaking…innovations”.

Nevertheless, this is a stretch for businesses as they do not associate this fundamental research with the commercial market opportunity. Subsequently, Higher Education and Research Institutions have had to pick up the slack.

Now let’s take a look at funding.

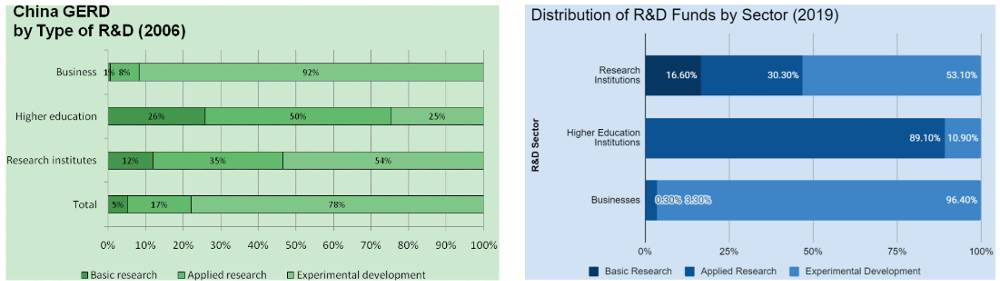

When compared to 2006, Higher Education and Research Institutions have redirected their focus and funding onto Basic and Applied research:

Source: Ministry of Science and Technology of China

*for Higher Education Institutions Basic and Applied Research are combined under ‘Scientific Research’

According to the data, in 2006 all three sector’s highest spend percentage was concentrated on experimental development. Whereas in 2019 although experimental development represents the largest share, basic and applied research have radically increased. Some experts have argued that as we stand on the edge of unlocking AI’s full potential, there will be another spike of investment in experimental development. This may be the case for technological enterprises, however Chinese government sponsorship has consistently tilted in favour of basic and applied research in an effort to encourage it.

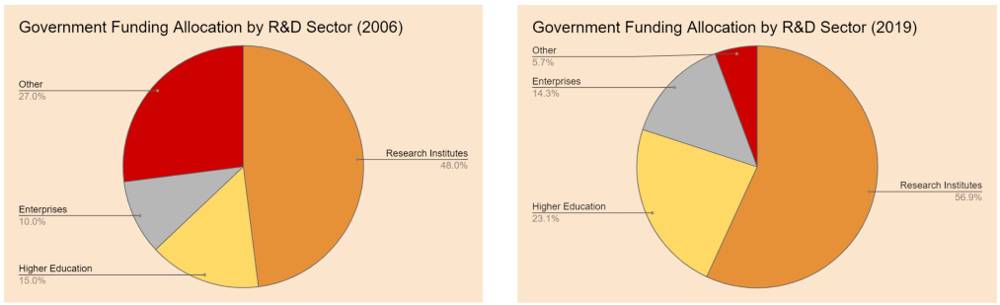

Government Funding for Research & Development has increased more significantly for Higher Education and Research Institutions

(China Statistical Yearbook on Science & Technology 2020)

The Chinese government has increased spending in all three sectors since 2006 with enterprises receiving the smallest share increase of 4%. Meanwhile Higher Education and Research Institutes have benefitted from an 8.1% and 8.9% increase respectively, reflecting the Chinese government’s desire to boost fundamental research.

These increases may seem marginal but they do not reflect the substantial growth of the IP industry. The estimated monetary value of patent commercialisation saw a ten-fold increase from 2012 to 2021, ballooning from 820 million to a massive 8.89 billion. It should also be noted that while the majority of data in this article has been extracted from Chinese sources, the data used correlates with the overall growth of the IP market.

From this data we can conclude that the Chinese market is ready for foreign patent commercialisation. This input is needed to fulfil the demand for growth and investment in basic and applied research, but what do foreign establishments have to gain from undertaking this challenge in China?

A Case in point:

The opportunity for foreign institutions can be exemplified through a case study of Chinese universities within the Higher Education sector. Over the last decade, there has been a surge in the number of successful patent grant applications. This is a result of both an increase in the overall number of patent applications submitted, as well as in the number of successful applications which rose drastically from 65.1% in 2012 to 83.9% in 2021. Furthermore, in that nine-year period, patents granted to Chinese Universities increased 346.4%, once again demonstrating the heightened focus and investment on Basic and Applied research. Historically, Chinese universities have demonstrated an open-attitude towards joint-venture partnerships with foreign academic institutions. Implying that foreign universities in particular should capitalise on the Chinese IP commercial market opportunity. A recent example is The Cambridge University – Nanjing Centre of Technology and Innovation collaboration (CUNJC). In which they created a network with leading Chinese universities, research institutes, and industry partners to successfully spin off various ‘deep’ tech startups in China.

Advantages and challenges of commercialising your IP in China

The first and foremost obvious advantage is accessing China’s notably vast market of cutting-edge technologies and applications. This is amplified through the US’s ‘de-risking’ and ‘decoupling’ (link to other article) from China, creating further demand for other foreign IP commercialisation and input. Additionally, the Chinese government’s strong appetite for commercialising innovative technologies and the associated practices stems from their objective of driving the Chinese economy up the value chain. This in turn is encouraging further investment into joint-venture technological exploration. Local bursaries have even been established within various industries for foreign enterprises willing to scale-up and commercialise their intellectual property in China.

This expansion into China creates an opportunity for external institutions to gain insights into Chinese business practices, further trade opportunities and consumer behaviours, which also allows for your business to set up a network and reach a consumer market with one of the largest populations in the world. A Chinese collaboration can also lead to the continued overall improvement and development of IP protection practices and standards. Subsequently, this will reinforce stronger walls of protection for those international businesses navigating the Chinese market. These increasing regulations are simultaneously causing a surge in patent filings in China, which was double the number of filings than in the US in 2021. Such policies have helped create a new breed of service enterprises whose business model is entirely based on serving the knowledge-intensive economy.

Unsurprisingly, this IP opportunity is substantially more complicated in practice due to a series of unique challenges that entering the Chinese IP market poses. A primary concern and struggle for many foreign businesses is tackling IP enforcement and regulatory obstacles.

This is notably more complex in the initial establishment phase in addition to the ongoing compliance maintenance. Despite Chinese IP laws and regulations progressively resembling international standards, the costly issues surrounding patent protection, prosecution, and maintenance can quickly become overwhelming due to China’s complex IP legal framework.

These issues are often antagonised further by the elevated levels of mutual distrust from foreign enterprises wanting to expand to the China market and are often met with hesitancy. This distrust makes it more complicated in acquiring the right business development contacts in the target company, whether it be a private or state owned enterprise.

Further down the IP commercialisation road, these barriers are replicated within the difficulty of accessing local entrepreneurial resources or HEI’s for spin-offs. Once again highlighting the importance of maintaining ongoing regulatory compliance, especially if the opportunity arises for technological transfers. In China tech transfers are and ought to be handled as unique, individual cases for each specific market opportunity. This is done to correctly identify which Chinese companies to target for what technology and how to legally implement the secondary tech support post-licensing process.

The most effective solution to this issue is having a physical, local presence to not only navigate cultural and linguistic barriers but also the general market and legal affairs. This would aid in building a trustworthy, reliable relationship that is capable of handling any disputes or competition within the Chinese innovation ecosystem. However without an already established presence, how can foreign businesses begin to take advantage of China’s commercial IP landscape?

A Ground-Breaking partnership model

Crayfish’s primary goal is to act as a trusted advisor and partner in helping businesses to succeed in China. Amongst our fixed digital platform of support services and tailored strategic consultancy, our core offering focuses on protecting your IP in China. In order for your business to succeed, we offer a range of services that include the mitigation of IP risks through careful planning and execution of:

- Market research with industry expertise across a range of sectors

- Tailored, strategic proposals

- Due diligence and ongoing monitoring of your IP

- Robust contracts and licensing agreements

- Establishing a local presence through us or a third-party partnership

We now offer UK IP owners a new partnership model that is designed to help you overcome these challenges with strategic entry plans and partnerships to increase overall success rates and reduce potential risks to a minimum.

Through helping develop proofs of concept and China focused business plans, we can fully engage target companies and investors to construct meaningful relationships with critical, local decision-makers and stakeholders. Crayfish’s established local footprint can become the cultural link with a bilingual team in your HQ base, levelling the playing field of local Chinese markets.

Acting as an integrated solution to support all your IP protection and commercialisation needs, our model will also be able to maximise the value of your overall patent family. Moreover, Crayfish and our joint venture partners Sinofaith IP group will execute and cover the costs of:

- Patent filing and prosecution in China

- Commercialisation in the Chinese market

- Any necessary enforcement of IP rights within the territory of China

In return, we ask for an exclusive right to conduct these activities on your behalf in China. You as the rights owner will receive a share of the income from our successful commercialisation, for patent sale, technology transfer and licensing, as well as for successful enforcement (including litigation). We will agree with you in advance regarding your global rights, right to buy-back and other terms & conditions of the partnership.

Contact us if you are interested in exploring the China potential.