“Strength lies in differences, not similarities.”

- Stephen Covey

Biopharma: China Speed & China Scale

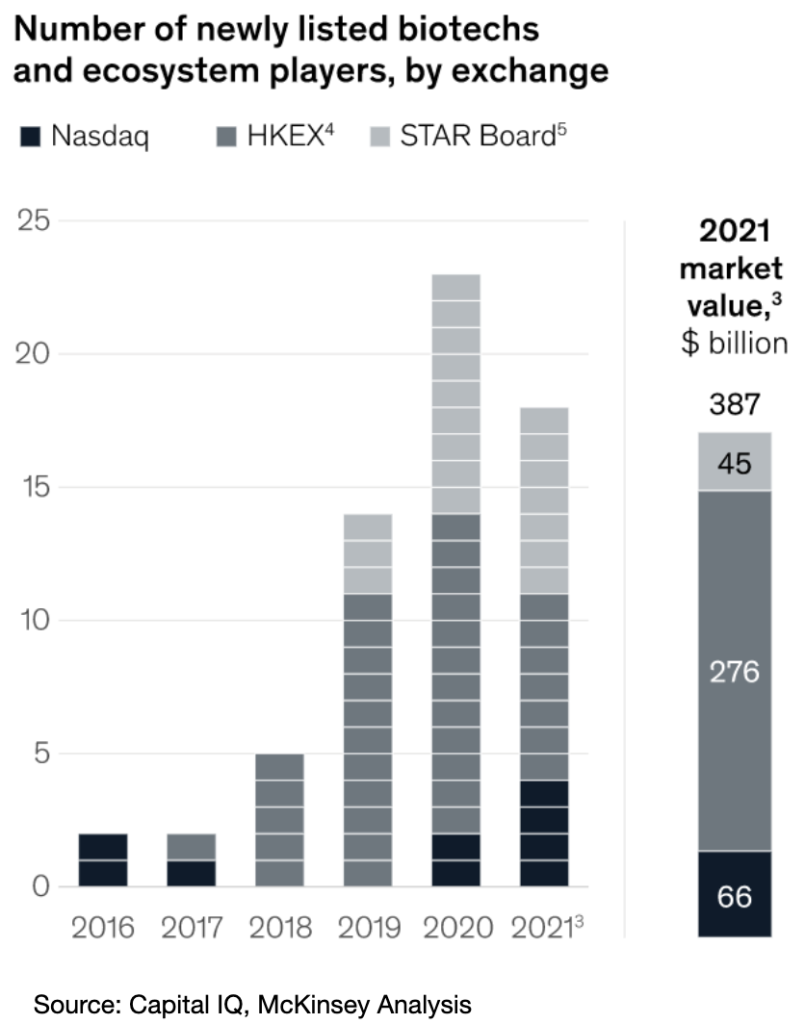

When it comes to doing business in China, the first thing to keep in mind is “China Speed”. As far as China’s biopharma industry is concerned, growth is rapid and exponential. One study, conducted by McKinsey, shows that the market value of China’s newly publicly listed biopharma innovation players skyrocketed from $3 billion in 2016 to more than $380 billion in July 2021. The second main factor to keep in mind is “China Scale”. During 2018 and 2020, China’s biopharma market accounted for seven of the world’s ten largest biopharma IPOs.

China: Rich with Diversity

While “China Speed” and “China Scale” are widely recognised, few have paid close attention to the great regional differences in China.

In 1935, demographer Hu Huanyong created Hu Line to illustrate the remarkable divide between East and West China, and his theory is still valid today. Vast differences also exist between North and South China, as well as China’s coastal areas and inland regions.

Generally speaking, China's coastal regions are much more developed than the inland areas, and South China is relatively ahead of the North. The same patterns can also be seen in China’s biopharma clusters.

Regional differences can be observed in various factors, from population distribution, economic development and the friendliness of business environments, to the availability of public health infrastructure and educational resources, as well as access to talent pools. The combination of these factors has had a significant impact on the development of China’s biopharma clusters.

Biopharma Clusters in China

China currently has five major biopharma clusters, all of which are centred in China’s most pivotal economic zones and built around their core cities, as well as connected to satellite cities. For instance, Shanghai is the leading city in the Yangtze River Delta and is linked to Suzhou, Wuxi, Taizhou, Hangzhou and Ningbo. While Beijing is the core city in the Costal Bohai Region and is linked to Tianjin, Dalian and Qingdao.

Choosing a Cluster

For overseas companies ambitious to get on the ride that is the explosive growth of China’s biopharma industry, one key question to consider is which cluster to move to. Thus, it is crucial to understand the characteristics and differences of each cluster before any strategic move, to ensure the most advantageous fit for business.

From a systematic perspective, the Yangtze River Delta, centred in Shanghai, is the leading cluster in most aspects in China’s biopharma. But other clusters also have their own unique positionings and merits. For instance, there are ample educational resources and public health infrastructure in the Costal Bohai Region, specifically in Beijing and Tianjin, enabling the area to lead in domestic new drug innovation. Whereas, the Pearl River Delta, which is home to many TCM (Traditional Chinese Medicine) companies and technology giants including Tencent and Huawei, is catching up by leveraging its strength in digitalization to transform biotech.

In summary, when deciding where to set up a first operation in China, foreign companies are highly recommended to first align their vision with the development goals of each biopharma cluster and to capitalise on the unique resources of each cluster to meet their business goals for the Chinese market.

How Crayfish Can Help

At Crayfish, we provide tailored solutions and are always happy to discuss ways to lead the way in China’s booming biopharma market, including location research and finding partners. Get in touch and book a free initial consultation with our life science specialist team.

Estella Ho is the Business Development Director for Asia at Crayfish.io. Based in Beijing, she has extensive consulting experiences in serving both private and public clients in the healthcare and wellbeing sector.